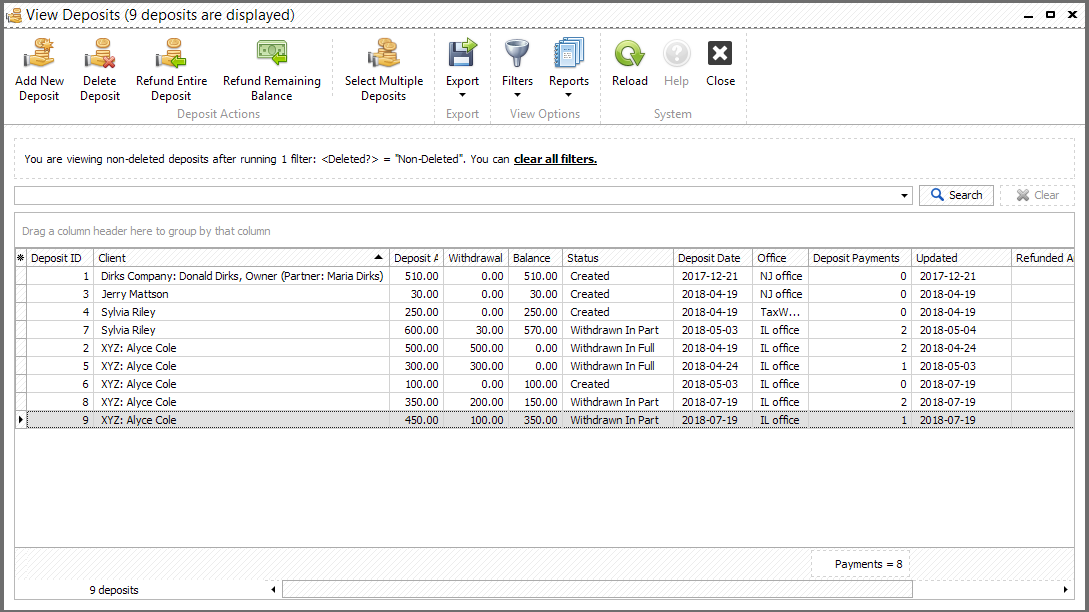

Deposits in TaxWorkFlow can be managed from "View Deposits" window:

There are several ways to create a new deposit:

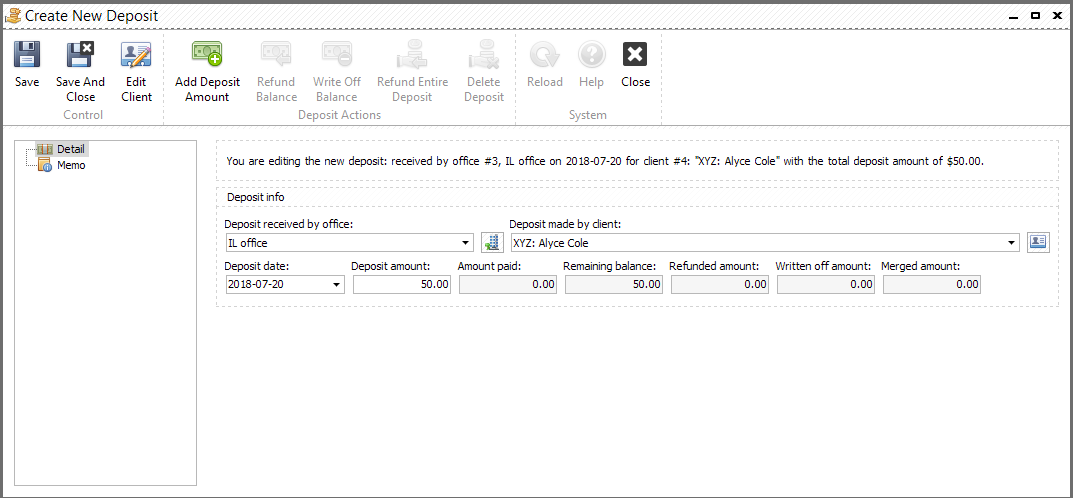

1. Click "Add New Deposit" button from "View Deposits" window. Select client and office and enter deposit amount in the appropriate field of the form or by clicking "Add Deposit Amount" button. Deposit date could be changed if needed:

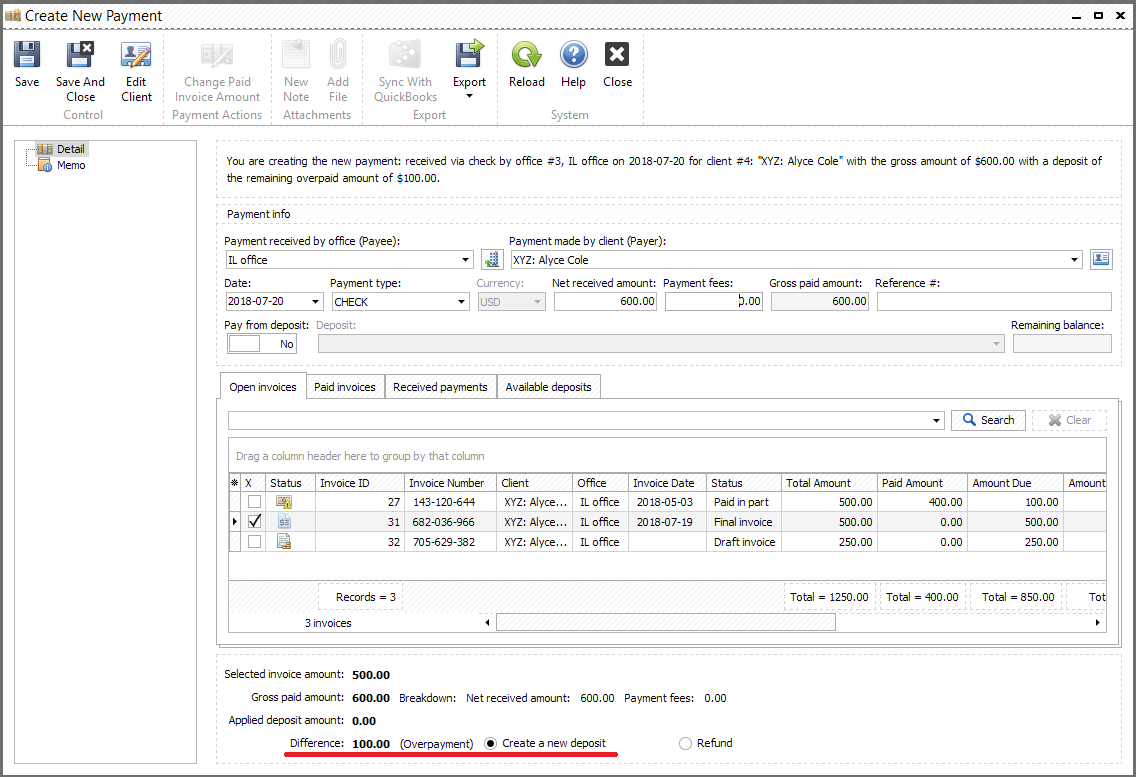

2. New deposit can be automatically created when the invoice is overpaid if you select this option. Another option is to refund overpaid amount:

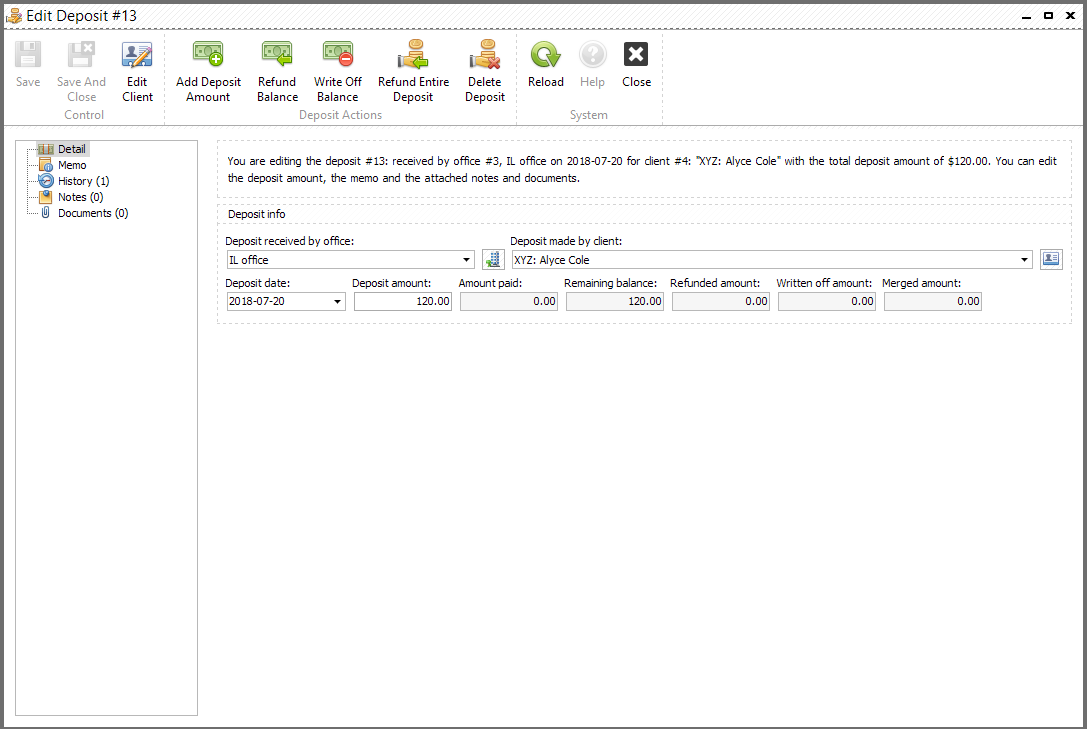

When the deposit is saved you can notes and documents to it. Also the following operations are available:

Add Deposit Amount allows you to add any amount to the deposit.

Refund Balance allows to refund remaining balance to the client. The status of the deposit will change to "Refunded in Full" if this deposit wasn't used in payments. If the deposit's status was "Withdrawn in part" the status will stay the same and the balance will be set to zero.

Write Off Balance allows to write off remaining balance. The status of the deposit will change to "Written Off in Full" if this deposit wasn't used in payments. If the deposit's status was "Withdrawn in part" the status will stay the same and the balance will be set to zero.

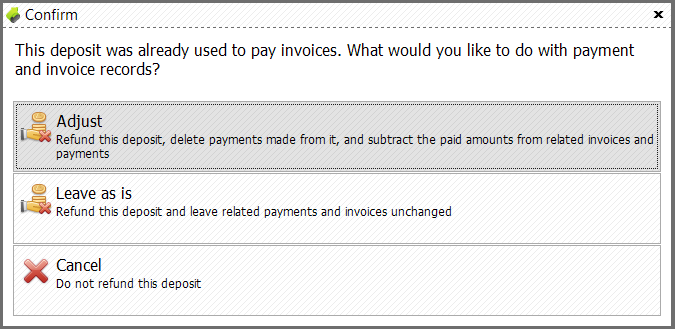

Refund Entire Deposit will change the status of deposit to "Refunded in Full" and set balance to zero. If the deposit was used in payments you can adjust payment and invoice records or leave them as is using the following dialog:

Delete Deposit allows you to permanently delete deposit from the system. If the deposit was used in payments you can adjust payment and invoice records or leave them as is using the dialog above.

Please note, if the deposit was already used and its status is "Withdrawn in Part" you can not decrease its amount.